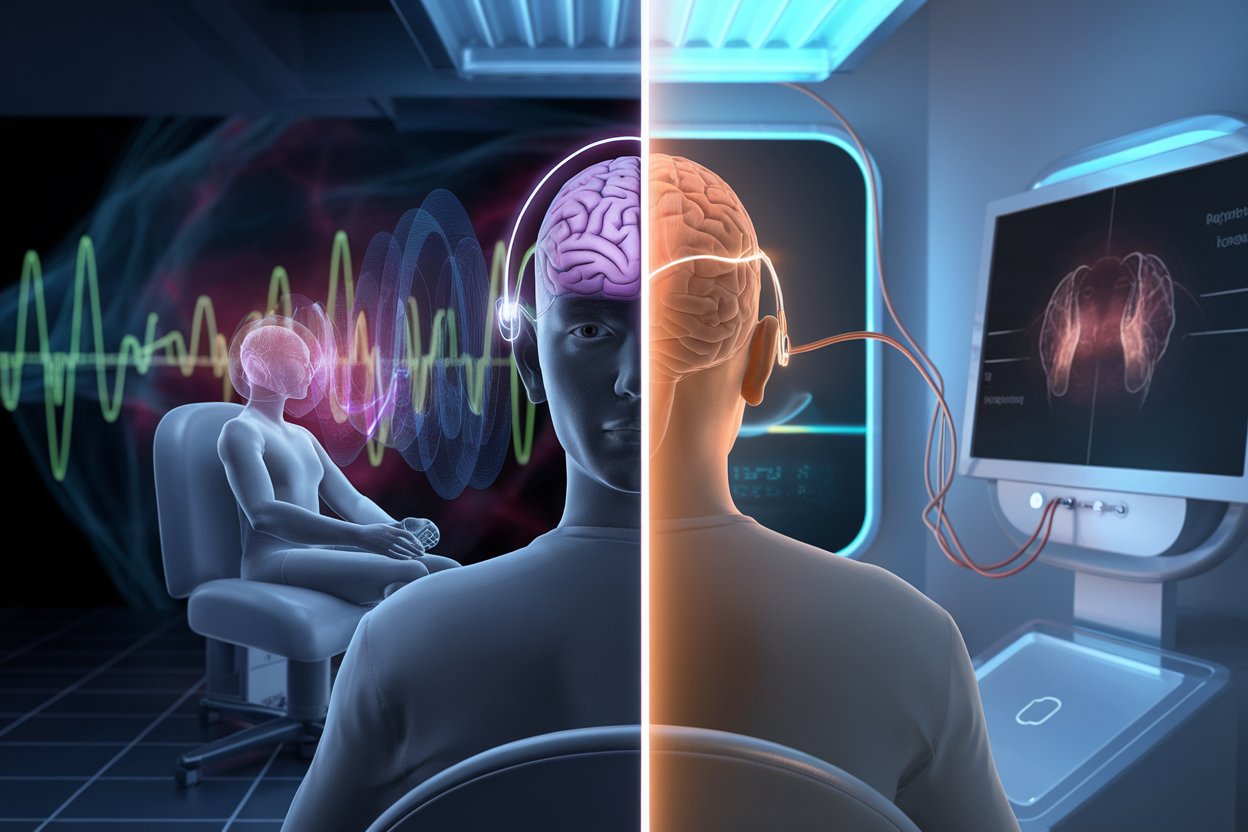

If you’re considering Transcranial Magnetic Stimulation (TMS) therapy, you may be wondering, “What insurance companies cover TMS therapy?” TMS is a noninvasive treatment that helps individuals with depression when other treatments like medication or talk therapy haven’t worked. But understanding if your insurance covers TMS can be a bit tricky. This guide will walk you through the details you need to know.

What is TMS Therapy?

TMS therapy is a treatment that uses magnetic pulses to stimulate nerve cells in the brain. It’s especially helpful for people who have not responded to traditional treatments for depression. TMS is typically done in a healthcare provider’s office, and you remain awake throughout the session. It’s important to know if your insurance will cover this treatment before starting.

Requirements for TMS Therapy Coverage

To understand what insurance companies cover TMS therapy, it’s essential to know the requirements. Most insurance providers have certain criteria you must meet before they approve coverage for TMS therapy. Generally, you need:

- A diagnosis of Major Depressive Disorder (MDD)

- Proof that you’ve tried at least two antidepressants without success

- Evidence of participation in talk therapy with little improvement

Meeting these requirements shows that you need a different approach to treatment, which makes TMS therapy an option that insurance companies may cover.

Which Insurance Companies Cover TMS Therapy?

The good news is that most major insurance companies cover TMS therapy if it is deemed medically necessary. Let’s explore which insurers typically provide coverage:

1. Aetna

Aetna covers TMS therapy for individuals who have tried at least two antidepressants with no lasting improvement. They may also require proof of failed psychotherapy attempts. It’s important to check with Aetna directly to understand the specific conditions of coverage.

2. Blue Cross Blue Shield (BCBS)

Blue Cross Blue Shield, including Anthem BCBS, often covers TMS therapy. However, the requirements can vary by state and policy. You generally need to show that you have tried at least two medications before qualifying for coverage.

3. Cigna

Cigna typically covers TMS therapy for those with a confirmed diagnosis of MDD who have not responded to two different classes of antidepressants. They may also require evidence of failed psychotherapy.

4. United Healthcare

United Healthcare provides coverage for TMS therapy, but they are a bit stricter. You will need to show that you have tried four different antidepressants without success. Checking with United Healthcare directly is advisable to understand the specifics of coverage.

5. Medicare and Medicaid

Medicare also covers TMS therapy, often paying for 80% of the treatment cost, with the patient covering the remaining 20%. Medicaid coverage varies by state. For example, currently, Medicaid covers TMS only in certain states, such as Washington.

Other Providers

Other insurance providers like Humana, Kaiser Permanente, Tricare, and Beacon Health also provide coverage for TMS, with specific requirements that must be met. It’s best to contact your provider directly to understand their criteria.

How to Improve Your Chances of TMS Coverage

Getting your insurance to cover TMS therapy can feel like a challenge, but there are some ways to improve your chances:

- Keep Detailed Records: Maintain accurate records of your treatment history, including all medications tried and therapy sessions attended.

- Follow Your Treatment Plan: It’s important to follow all treatment recommendations completely. Missing therapy sessions or doses of medication could make it harder to get approval for TMS therapy.

- Talk to Your Doctor: Your healthcare provider can help support your request for coverage. They can provide documentation showing that TMS is medically necessary for you.

Potential Reasons for Denied Coverage

While many insurance companies cover TMS therapy, there are some situations where coverage may be denied. Common reasons include:

- Pregnancy: Some insurers do not cover TMS for pregnant women due to a lack of research on its safety for the unborn child.

- Ongoing Substance Abuse: If you have ongoing substance abuse issues, your insurance provider might not approve TMS therapy.

- Other Medical Conditions: Having a medical condition like epilepsy or a seizure disorder can also make it harder to get insurance approval for TMS.

If your coverage is denied, consider appealing the decision or exploring financing options to help cover the cost.

What to Do If Your Coverage is Denied

If your insurance company denies your coverage for TMS therapy, there are still options available:

- Appeal the Decision: You have the right to appeal the decision. Work with your doctor to provide additional evidence that supports your need for TMS therapy.

- Medical Financing Programs: Some clinics offer medical financing to help make TMS therapy more affordable. You can also look for sliding-scale payment options based on your income.

- Explore Alternative Treatments: If TMS is not an option, consider other treatments like medication adjustments or different forms of therapy.

Important Questions to Ask Your Insurance Provider

Before starting TMS therapy, it’s wise to contact your insurance provider and ask specific questions about coverage:

- Is TMS Therapy Covered Under My Plan? Make sure to ask if TMS is included in your policy.

- What Are the Requirements for Coverage? Understand what criteria you need to meet to be eligible for coverage.

- Do I Need Prior Authorization? Some insurance providers require prior authorization before starting TMS.

Summary

What insurance companies cover TMS therapy? The answer is that many major insurance companies do, including Aetna, Blue Cross Blue Shield, Cigna, United Healthcare, and even Medicare. Each insurer has its own set of requirements, such as trying a certain number of antidepressants or undergoing talk therapy before TMS coverage is approved. It’s crucial to keep accurate records of your treatment journey and work closely with your healthcare provider to improve your chances of coverage.

If you’re interested in TMS therapy, start by contacting your insurance provider to learn more about your specific plan’s requirements. And remember, there are always options available, even if your coverage is initially denied. You deserve the best care for your mental health, and understanding your insurance options can help make TMS therapy accessible to you.

Take the Next Step Toward Better Mental Health Today

If you believe TMS therapy could be the right treatment for you, contact American TMS Clinics today to discuss your insurance coverage and eligibility. Our team is ready to assist you every step of the way.